Reading time: ~30 minutes.

Table of Contents:

- Executive Summary: Sustainable Real Estate Price Growth on Phangan

- Introduction: The Evolving Real Estate Landscape of Phangan

- Annual Property Appreciation on Phangan

- Key Factors Driving Property Value Growth

- Investment Potential and Rental Yields

- Market Outlook and Future Trends

- Brief Comparison with Other Mature Thai Island Markets (Phuket, Samui)

- Recommendations for Potential Investors

- Conclusion: The Enduring Investment Appeal of Phangan

1. Executive Summary: Sustainable Real Estate Price Growth on Phangan

The real estate market on the island of Phangan is showing significant growth, making it an attractive destination for investors.

1.1 Key Findings on Property Appreciation

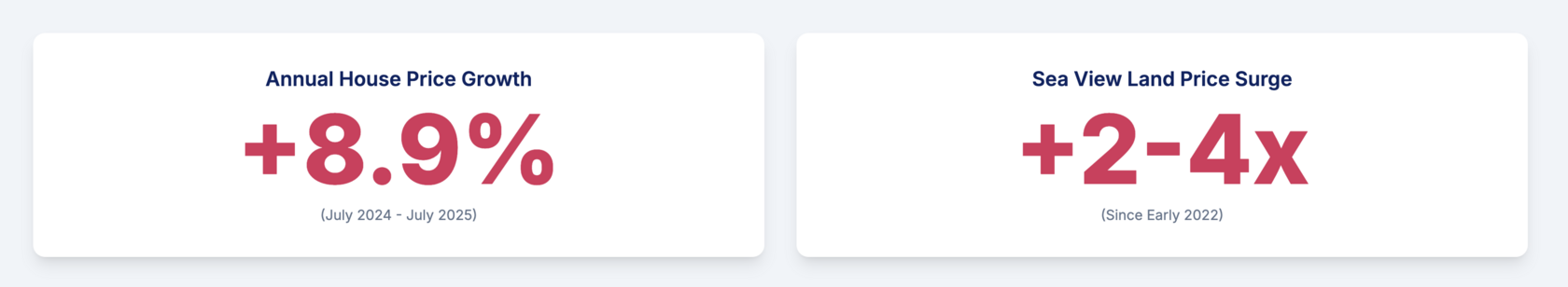

The value of residential property on Phangan has seen a substantial increase. Specifically, house prices have appreciated by 8.9% year-on-year from July 2024 to July 2025(1). This figure is consistent with the historical trend of 5−10% annual growth observed since 2016(2).

Land prices, particularly on the highly sought-after western coast, have experienced an even more dramatic jump, increasing 2 to 4-fold since early 2022(3). This reflects high demand and a critically limited supply.

Land prices, particularly on the highly sought-after western coast, have experienced an even more dramatic jump, increasing 2 to 4-fold since early 2022(3). This reflects high demand and a critically limited supply.

"Property values on the island are rising mainly because Phangan has become a global hub for digital nomads. Combined with the post-COVID tourism recovery, strong foreign investment, and limited supply of land and completed homes, this creates a powerful driver for growth," Michael Skiba, co-owner of the development company Koh Phangan Estate, commented.

Phangan offers attractive investment opportunities, characterized by high rental demand and a potential for annual net yields often exceeding 10% for villas(1). The historical relative affordability compared to established luxury markets like Phuket and Samui initially drove investor interest, though prices are now rapidly approaching the levels of those markets(3).

2. Introduction: The Evolving Real Estate Landscape of Phangan

2.1 Overview of the Island's Appeal

Phangan, traditionally known for its pristine natural beauty and vibrant cultural events, has undergone a rapid transformation. It has evolved into one of the leading destinations for long-term residents, digital nomads, and affluent travelers(2), greatly expanding its appeal beyond transient tourism. This shift is supported by improved infrastructure and a growing number of high-end amenities, which positions the island as an attractive yet distinct alternative to more developed Thai islands like Phuket and Samui(2).

2.2 Brief Historical Context of the Property Market

Historically, Phangan’s real estate market was more niche and offered comparatively lower prices than its larger, established neighbors. However, since approximately 2016, the island has experienced a "dramatic" increase in prices, establishing a "steady 5 to 10% year-on-year increase"(2).

The reopening of international borders in early 2022 after the COVID-19 pandemic served as a tipping point, sparking a pronounced "property boom" as international investors, including those from Bangkok, actively entered the market(3).

3. Annual Property Appreciation on Phangan

3.1 Detailed Analysis of House Price Changes

The most recent and specific data shows that the price per square meter for houses on Phangan increased by +8.9% when comparing data from July 2024 to July 2025(1). This figure provides the most direct and current annual appreciation for residential homes on the island.

While the annual trend is strongly positive, short-term fluctuations are evident. Prices showed a +5.1% increase compared to January 2025 but a -5.4% decrease compared to June 2025(1). These month-to-month changes are typical of dynamic markets and do not negate the strong long-term growth.

The current 8.9% annual growth rate is consistently in line with the previously reported "steady 5 to 10% year-on-year increase since 2016" for the Phangan real estate market(2). This long-term consistency highlights a fundamental and sustainable growth trajectory, indicating that the recent appreciation is part of a broader, established trend rather than an isolated spike.

While the annual trend is strongly positive, short-term fluctuations are evident. Prices showed a +5.1% increase compared to January 2025 but a -5.4% decrease compared to June 2025(1). These month-to-month changes are typical of dynamic markets and do not negate the strong long-term growth.

The current 8.9% annual growth rate is consistently in line with the previously reported "steady 5 to 10% year-on-year increase since 2016" for the Phangan real estate market(2). This long-term consistency highlights a fundamental and sustainable growth trajectory, indicating that the recent appreciation is part of a broader, established trend rather than an isolated spike.

An important discrepancy arises from Properstar data(4), which reports a -29% change over 12 months for houses on Phangan. This figure is in direct contrast to the +8.9% annual increase from Hipflat(1) and the historical 5−10% annual growth cited by Conrad Properties(2).

.

Given the overwhelming qualitative and quantitative data from multiple sources confirming strong positive growth(1), the -29% figure from(4) should be critically evaluated and considered an anomaly. It may represent a very specific, possibly distressed or older, sub-segment of the market, or a statistical anomaly due to data collection methodology or sample size. The primary and more reliable picture, supported by a wider range of evidence, is of significant appreciation. This discrepancy highlights an important aspect of analyzing developing or niche markets: data can be fragmented, inconsistent, or represent very specific sub-segments. It underscores the importance of cross-referencing information from multiple sources and understanding that not all "homes" in a market appreciate uniformly. For example, newer, luxurious, or sea-view villas (as detailed in 3) are likely the drivers of the overall positive appreciation, while older, less desirable, or distressed properties may indeed be experiencing a decline, skewing overall averages if not properly segmented. A report should prioritize the overall positive trend supported by the majority of evidence while acknowledging the potential for varied performance within specific property types or locations on the island.

.

Given the overwhelming qualitative and quantitative data from multiple sources confirming strong positive growth(1), the -29% figure from(4) should be critically evaluated and considered an anomaly. It may represent a very specific, possibly distressed or older, sub-segment of the market, or a statistical anomaly due to data collection methodology or sample size. The primary and more reliable picture, supported by a wider range of evidence, is of significant appreciation. This discrepancy highlights an important aspect of analyzing developing or niche markets: data can be fragmented, inconsistent, or represent very specific sub-segments. It underscores the importance of cross-referencing information from multiple sources and understanding that not all "homes" in a market appreciate uniformly. For example, newer, luxurious, or sea-view villas (as detailed in 3) are likely the drivers of the overall positive appreciation, while older, less desirable, or distressed properties may indeed be experiencing a decline, skewing overall averages if not properly segmented. A report should prioritize the overall positive trend supported by the majority of evidence while acknowledging the potential for varied performance within specific property types or locations on the island.

3.2 Examining Land Price Growth and Its Significance

Land prices, especially for highly sought-after sea-view plots on the western coast (including areas like Hin Kong — Srithanu, Wok Tum, Haad Yao, and Haad Salad), have experienced an extraordinary 2 to 4-fold increase since the beginning of 2022(3). This means a plot that could have been acquired for around 3 million Thai Baht before COVID-19 is now valued at 8−10 million Thai Baht, with the most prime plots in Haad Yao commanding 9−15 million Thai Baht per rai(3).

This rapid and substantial land value appreciation is a powerful leading indicator of underlying market confidence and the potential for future development. Because land is a finite resource, especially in prime island locations, its dramatic appreciation directly influences the cost of new construction, thereby supporting higher overall property prices for both new and existing properties.

The 2 to 4-fold land price increase(3) significantly outpaces the 8.9% annual appreciation for built homes(1). This disparity indicates that the underlying land value is appreciating at a much faster rate than the structures built upon it. The core reason for this lies in scarcity: land, particularly prime sea-view plots on the island, is a finite resource. The surge in demand from digital nomads and foreign investors(3) directly impacts the most limited resource first.

This rapid land appreciation has direct causal links to the broader property market. First, it significantly increases the cost of new developments, as developers must acquire land at a higher price. This, in turn, translates to higher sale prices for new villas and homes, thereby putting upward price pressure on the value of existing properties. Second, it signals strong investor confidence in the island’s long-term growth potential, as buyers are willing to pay a substantial premium for the underlying asset. This dynamic means that future inventory will be inherently more expensive to bring to market, which is likely to sustain upward price pressure on both new and resale properties.

The 2 to 4-fold land price increase(3) significantly outpaces the 8.9% annual appreciation for built homes(1). This disparity indicates that the underlying land value is appreciating at a much faster rate than the structures built upon it. The core reason for this lies in scarcity: land, particularly prime sea-view plots on the island, is a finite resource. The surge in demand from digital nomads and foreign investors(3) directly impacts the most limited resource first.

This rapid land appreciation has direct causal links to the broader property market. First, it significantly increases the cost of new developments, as developers must acquire land at a higher price. This, in turn, translates to higher sale prices for new villas and homes, thereby putting upward price pressure on the value of existing properties. Second, it signals strong investor confidence in the island’s long-term growth potential, as buyers are willing to pay a substantial premium for the underlying asset. This dynamic means that future inventory will be inherently more expensive to bring to market, which is likely to sustain upward price pressure on both new and resale properties.

3.3 Contextualization with Broader Thailand Real Estate Market Trends

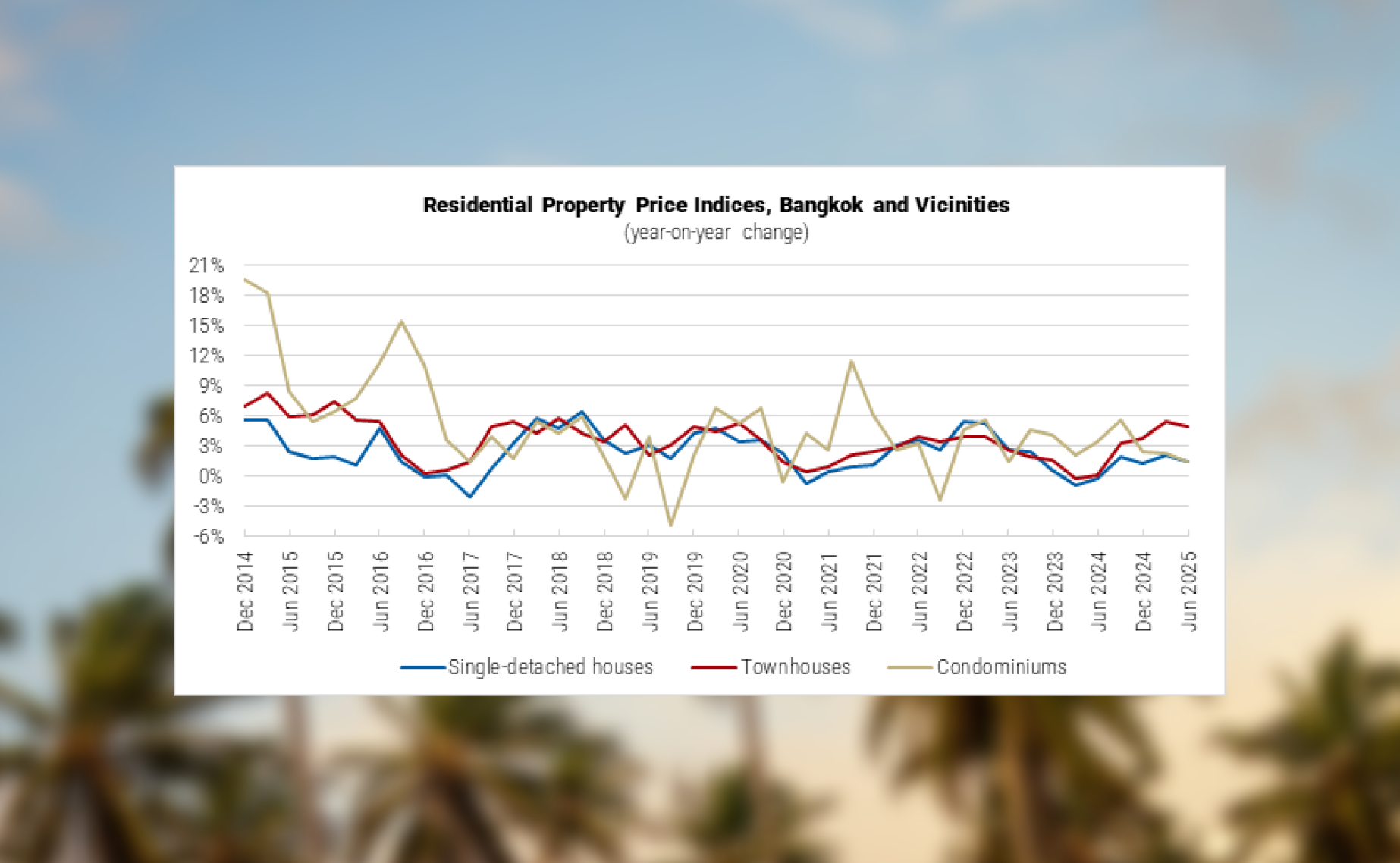

Nationally, housing prices in Thailand are projected to increase by 5−10% in 2025(6) This indicates a generally robust national real estate market, and Phangan’s 8.9% annual house price appreciation rate firmly places it within or at the top end of this national average for general housing.

Specific national market segments show varied growth rates, with prices for single-detached houses increasing by 2.55% year-on-year and townhouses by 3.53% year-on-year in Q4 2024(8) The condominium segment nationally saw a price growth deceleration to 2.46% year-on-year(8).

Specific national market segments show varied growth rates, with prices for single-detached houses increasing by 2.55% year-on-year and townhouses by 3.53% year-on-year in Q4 2024(8) The condominium segment nationally saw a price growth deceleration to 2.46% year-on-year(8).

Phuket, another highly popular island destination in Thailand, serves as a valuable benchmark for fast-growing island markets. Land prices there have increased by an average of 10.7% annually over a 20-year period from 2004 to 2024(9).

Phangan’s more recent but significantly higher land price appreciation (2 to 4-fold since 2022) suggests it is either rapidly catching up to or, in some segments, even surpassing the growth rates seen in more established island markets. A comparative analysis shows that Phangan’s 8.9% house price appreciation(1) is at the top end or even exceeds national averages for single-detached homes (2.55%) and townhouses (3.53%) in Q4 2024(8), and fits well within the broader national 5−10% forecast for 2025(6). This suggests that Phangan is not just benefiting from a general Thailand real estate recovery, but is experiencing a unique, accelerated growth phase, particularly pronounced in its land market.

Phangan’s more recent but significantly higher land price appreciation (2 to 4-fold since 2022) suggests it is either rapidly catching up to or, in some segments, even surpassing the growth rates seen in more established island markets. A comparative analysis shows that Phangan’s 8.9% house price appreciation(1) is at the top end or even exceeds national averages for single-detached homes (2.55%) and townhouses (3.53%) in Q4 2024(8), and fits well within the broader national 5−10% forecast for 2025(6). This suggests that Phangan is not just benefiting from a general Thailand real estate recovery, but is experiencing a unique, accelerated growth phase, particularly pronounced in its land market.

This accelerated growth can be attributed to its "emerging" status, its previous relative undervaluation compared to more established islands, and the specific, highly sought-after niche (digital nomads, certain foreign buyer groups) it has successfully cultivated. This niche demand is less diluted than in larger, mature markets. For investors seeking higher capital appreciation potential, Phangan may represent a more dynamic opportunity than the broader Thailand market or even other islands that have already reached a higher level of maturity and valuation.

A review of research materials indicates that major international real estate consulting firms, such as Knight Frank(10), CBRE(12), and JLL(14), provide extensive market reports for key Thai cities and established resort destinations like Bangkok, Phuket, and Samui. However, these firms notably lack specific, dedicated market reports or data on Phangan. This omission suggests that despite its rapid growth, Phangan may still be considered a more niche or developing market for these large institutional players, or that consolidating comprehensive data for the island is more challenging at their scale. For prospective investors, this fragmented data landscape means that easily accessible, consolidated market information on Phangan from traditional institutional sources is limited. Consequently, reports that meticulously use data from various local agencies and specialized property portals (e.g., Hipflat, Sense Property, Conrad Properties) become exceptionally valuable for providing a holistic and detailed market overview. It also highlights the paramount importance of utilizing local, on-the-ground expertise and information to navigate this market, rather than relying solely on broader national or regional analysis. Furthermore, the lack of extensive institutional coverage could be interpreted as a first-mover advantage, as the market may not yet be fully "discovered" and priced by large-scale institutional investment, potentially allowing for higher initial returns.

3.4 Annual Property Price Dynamics on Phangan

(July 2024 – July 2025)

4. Key Factors Driving Property Value Growth

4.1 Impact of Foreign Investment and Tourism Recovery

The reopening of international borders after the COVID-19 pandemic served as a major catalyst for Phangan’s "property boom", attracting a "rush of investors from all over the world"(3). This influx of global capital and demand has been a key driver. Foreign buyers, particularly from Russia and China, have made a "significant mark" on the broader Thailand condo market(6), and their interest is clearly extending to island destinations like Phangan, as implied by the general "rush of investors"(3)

Government initiatives, such as the offering of visa-free travel, further incentivize these foreign transactions and contribute to market activity(6) The ongoing tourism recovery, evidenced by a surge in tourist arrivals across Thailand(15), directly fuels demand for both short-term vacation rentals and long-term second homes, thereby solidifying the investment appeal of residential properties on the island.

Research data clearly establishes a causal link between tourism recovery(15), government visa policies(6), and the surge in foreign real estate investment(3). This is not merely a correlation but a direct cause-and-effect chain.

"Government policies that simplify entry and investment for foreigners — like visa waivers or digital nomad programs — immediately boost demand, whether it’s for tourist rentals, long-term homes, or second residences for remote workers," Michael Skiba, co-owner of the development company Koh Phangan Estate, commented.

The health and trajectory of Phangan’s property market, being highly dependent on international tourism and foreign capital, is inherently sensitive to global travel policies, geopolitical events, and the stability of international relations. Any changes in visa regulations, shifts in foreign buyer sentiment due to global events, or economic downturns in key source countries could significantly impact demand and, consequently, property values. Investors should monitor these broader external factors as critical indicators of the market’s sustainability.

4.2 Economic Factors Influencing the Market

Rising construction costs and increasing land prices have been identified as national factors driving up residential property prices across Thailand(6). This factor is particularly relevant for Phangan, where land prices have already experienced an extraordinary jump(3), which directly increases the cost of new developments and thus pushes up final property prices.

The projected increase in the national minimum wage to 400 Baht is also mentioned as a contributing factor to rising housing prices across Thailand(6). This impacts the labor costs for construction and ongoing property maintenance. The Bank of Thailand is "on track to hike interest rates," and home loan availability is expected to decline, with mortgage loan rejection rates potentially hitting 60−65%(6). This indicates a tightening of domestic credit conditions.

The presented economic factors have a dual impact on the market. Rising construction costs(6) and a higher minimum wage(6) directly contribute to an increase in supply-side costs, which inevitably leads to higher property prices. Conversely, rising interest rates and declining home loan availability(6) significantly curb domestic purchasing power and demand. This suggests that the current price appreciation in highly sought-after areas like Phangan may be driven more strongly by a combination of supply-side cost inflation and resilient foreign demand (which is often less dependent on local mortgage loans), rather than high domestic demand alone.

This dynamic could make the Phangan market potentially more resilient to domestic economic headwinds, as it relies on external capital. However, it also makes the market more sensitive to global capital flows and the economic health and confidence of key foreign buyer groups.

4.3 Supply and Demand Dynamics and Limited Supply

Phangan is characterized by a "more limited supply of Property for Sale" compared to its larger neighbor, Samui, which allows owners and developers to "dictate their entry level prices"(5) This inherent scarcity creates a seller’s market.

There is a "soaring demand for resale villas due to the limited number of projects with completed show units"(3) This imbalance between high demand and a constrained supply is a critical factor leading to the explicit forecast that "prices should continue to increase in the next few years"(3)

There is a "soaring demand for resale villas due to the limited number of projects with completed show units"(3) This imbalance between high demand and a constrained supply is a critical factor leading to the explicit forecast that "prices should continue to increase in the next few years"(3)

Limited supply is a defining feature of island real estate. With little room for expansion, demand quickly outpaces available land and properties, creating a "scarcity premium". This makes Phangan’s market more resilient to downturns and explains why land appreciates faster than built homes — it is the finite resource driving competition.

4.4 Unique Characteristics of the Phangan Market

Phangan is emerging as a hub for digital nomads, whose longer stays and demand for both rentals and property purchases distinguish the island from purely tourist-driven markets(3). At the same time, it is becoming a choice for affluent buyers, attracting luxury developers, high-end restaurants, and hotels(2).

Earlier, the island was known for its comparatively low property prices versus Phuket and Samui(3), which drew early investors and fueled the sharp appreciation seen as infrastructure and lifestyle offerings improved. This marks a market revaluation: from a bohemian backpacker spot to a recognized destination for long-term living and investment. With rising quality of life, improved infrastructure, and a reputation for premium development, Phangan now appeals to a more stable and diversified demand base.

Earlier, the island was known for its comparatively low property prices versus Phuket and Samui(3), which drew early investors and fueled the sharp appreciation seen as infrastructure and lifestyle offerings improved. This marks a market revaluation: from a bohemian backpacker spot to a recognized destination for long-term living and investment. With rising quality of life, improved infrastructure, and a reputation for premium development, Phangan now appeals to a more stable and diversified demand base.

Notably, over half of the island is protected under Than Sadet–Ko Pha‑ngan National Park, which covers about 66 km² of the island’s 125 km² area. This conservation zone bans construction and significantly limits developable land, reinforcing scarcity and the island’s appeal for investors seeking long‑term capital appreciation.

5. Investment Potential and Rental Yields

5.1 Discussion of Typical Villa and Land Price

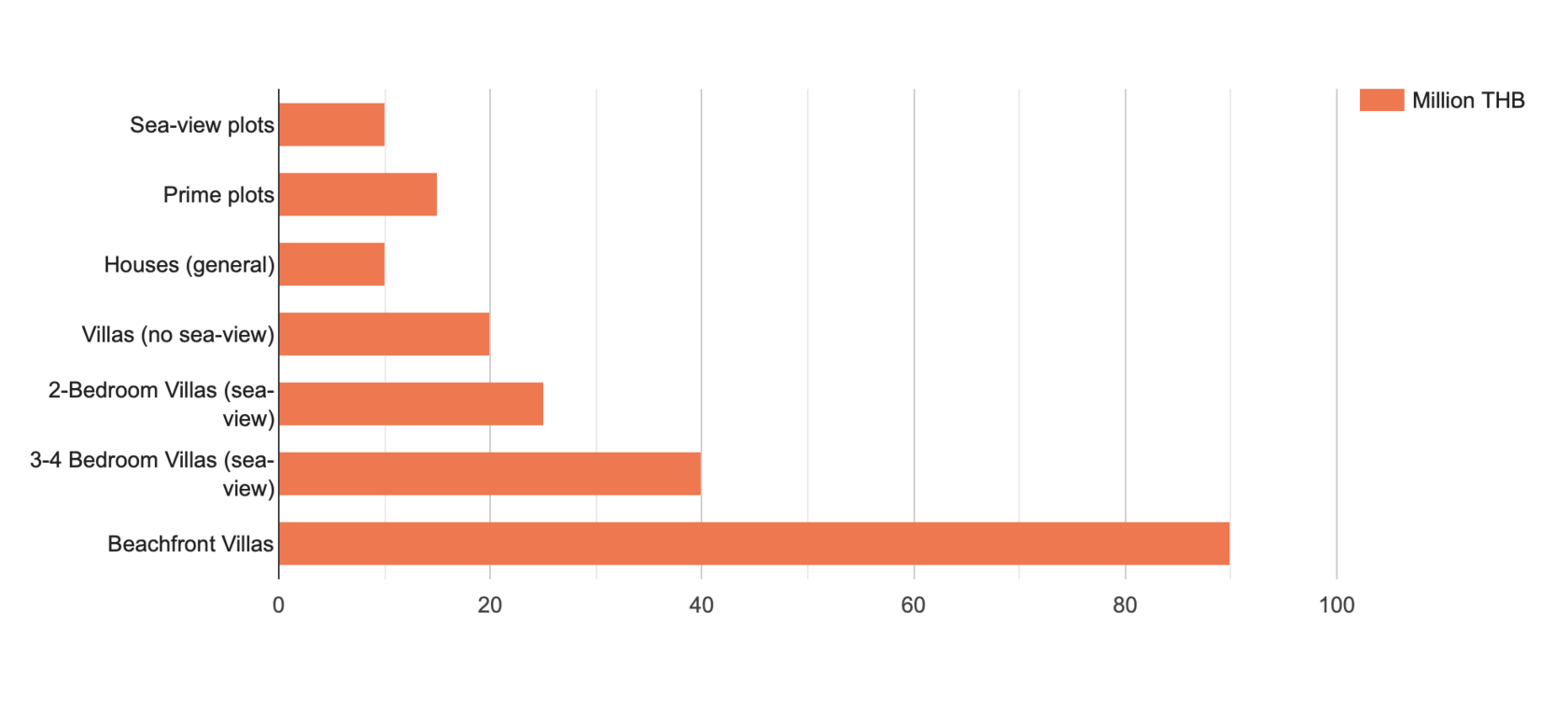

LAND

- Sea-view land on the western coast that cost approximately 3 million Thai Baht per rai before COVID-19 is now valued at 8−10 million Thai Baht per rai as of February 2024.

- Prime plots in Haad Yao can fetch even more, at 9 to 15 million Thai Baht per rai(3).

VILLAS

- Houses (general): The average price for houses on Phangan is 3,5 to 10 million Thai Baht(1).

- Villas without sea-view: generally range from 10 to 20 million Thai Baht(5).

- 2-bedroom sea-view villas: typically range from 15 to 25 million Thai Baht(3).

- 3- or 4-bedroom sea-view villas (already built or sold off-plan): typically range from 20 to 40 million Thai Baht(3).

- Resale 3-bedroom sea-view villas on circa 1,000 sqm plots: are now selling for 20−45 million Thai Baht, indicating a strong demand for existing stock(3).

- Beachfront villas generally range from 40 to 90 million Thai Baht(5).

COVID DISCOUNTS

While land prices were largely unaffected by the pandemic, some individual owners offered 10−30% discounts on older properties due to personal financial distress(5). However, new and popular projects, due to limited supply, offered fewer discounts or incentives, highlighting the market’s resilience even during a global crisis.

While land prices were largely unaffected by the pandemic, some individual owners offered 10−30% discounts on older properties due to personal financial distress(5). However, new and popular projects, due to limited supply, offered fewer discounts or incentives, highlighting the market’s resilience even during a global crisis.

5.2 Typical Property Prices and Rental Yields on Phangan

6. Market Outlook and Future Trends

6.1 Forecasts for Further Market Dynamics

Local market experts explicitly state that "the limited supply means prices should continue to increase in the next few years"(3) This is a strong forward-looking statement that indicates sustained upward price pressure. The overall Thailand real estate market is poised for continued growth, with a recovery in transaction volume and value expected from 2025 onwards(8).This positive national trend provides a favorable macroeconomic backdrop for continued property appreciation on Phangan.

6.2 Factors That Could Affect Future Growth or Pose Challenges

- Sustained Foreign Demand

- Infrastructure Development

- Building Regulations and Supply Control

- Global Economic Headwinds

- Domestic Economic Factors

7. Brief Comparison with Other Mature Thai Island Markets (Phuket, Samui)

- Phuket

- Samui

- Phangan’s Niche

This comparative analysis suggests that Phangan presents an attractive opportunity for investors seeking higher growth potential in an "emerging luxury" segment. It offers the prospect of significant capital appreciation as its trajectory towards greater maturity continues. In contrast, Phuket and Samui, having already reached higher valuation plateaus, may offer more stable but potentially lower future growth rates. The choice of island for investment would thus depend on an investor’s specific risk appetite, desired growth profile, and long-term strategic goals.

8. Recommendations for Potential Investors

8.1 Strategic Advice for Navigating the Phangan Real Estate Market

- Act Decisively on Land

- Consider Resale Villas

- Focus on High-Demand Areas

- Due Diligence on Management

8.2 Considerations for Different Investment Goals

- For Capital Appreciation

- For Rental Income

- For Long-Term Ownership

9. Conclusion: The Enduring Investment Appeal of Phangan

9.1 Summary of Strong Investment Appeal and Growth Trajectory

The real estate market on Phangan is currently in a phase of dynamic and sustained growth, clearly evidenced by a significant 8.9% annual house appreciation and an exceptional 2 to 4-fold increase in land prices since early 2022. This impressive growth is underpinned by strong fundamental factors, including the island’s rising status as a hub for digital nomads and affluent individuals, consistent and resilient foreign investment, and a critical scarcity of desirable properties. The market offers a compelling dual investment proposition, combining the potential for substantial capital appreciation with attractive rental yields, making it highly appealing to discerning investors seeking both growth and income.

9.2 Final Outlook

While some broader national real estate trends may suggest moderation, Phangan’s unique market drivers, combined with its inherently limited supply, strongly indicate that the island is poised for continued robust growth in the coming years. Its remarkable evolution from a niche destination to a sought-after investment hub solidifies its position as a standout performer in the broader Thailand real estate market.

Contact us

If you plan to purchase property on Koh Phangan, consult our specialists. Koh Phangan Estate offers several unique properties starting at 2,900,000 THB. Find out more about our projects via the links:

- Alma Terra Villas — Sea view two-level villas.

- 7 Palms — East living units with landscape design and a 20-meters pool.

For additional information, ask questions to our experts via social media, messengers, or through provided contact numbers:

+66 93 553 2960 (WhatsApp/Line/ Telegram) — Michael Skiba.

+66 93 553 2960 (WhatsApp/Line/ Telegram) — Michael Skiba.

The analysis was conducted with the assistance of Google’s LLM.

Sources:

Sources:

- Houses for sale in Ko Pha-ngan, Surat Thani | Hipflat https://www.hipflat.com/house-for-sale/surat-thani/ko-phangan

- Thailand Real Estate Market Outlook 2021 - Conrad Properties https://www.conradproperties.asia/blog-news/thailand-real-estate-market-outlook-2021

- Koh Phangan, a digital nomad's hub - and a fast-growing property, https://senseproperty.com/news/koh-phangan-a-digital-nomads-hub-and-a-fast-growing-property-market

- 155 Properties for Sale in Ko Pha-ngan District - Price Drops | Properstar https://www.properstar.com/thailand/ko-pha-ngan-district/buy/biggest-price-drops

- The Best Selection of Houses for Sale on Koh Phangan - Conrad Properties https://www.conradproperties.asia/property-for-sale-koh-phangan

- Next Year Property Trends in Thailand | FazWaz https://www.fazwaz.com/advice/next-year-property-trends-in-thailand

- Koh Samui Real Estate - Koh Samui Properties - Land For Sale https://samui-island-realty.com/

- Thailand's Residential Property Market Analysis 2025 https://www.globalpropertyguide.com/asia/thailand/price-history

- Soaring Prices and Scarce Land in Phuket's Real Estate Market https://www.siamrealestate.com/news/soaring-prices-and-scarce-land-in-phukets-real-estate-market

- Knight Frank Thailand: Real Estate Agents in Thailand - Residential https://www.knightfrank.co.th/

- Nattha Kahapana - Knight Frank https://www.knightfrank.com/contact/people/nattha-kahapana-thkfp009

- Residential | CBRE Thailand https://www.cbre.co.th/services/property-types/residential

- Thailand - CBRE https://www.cbre.com/-/media/project/cbre/shared-site/apac/thailand/2023-thailand-market-outlook-post-event/thailand-capabilities-statement-2023.pdf

- JLL Predicts Robust Real Estate Investment in Thailand for 2025 https://www.jll.com/en-sea/newsroom/jll-predicts-robust-real-estate-investment-in-thailand-for-2025

- Thailand real estate to show ongoing resiliency in 2024: JLL | RE Talk Asia https://www.retalkasia.com/news/2024/02/29/thailand-real-estate-show-ongoing-resiliency-2024-jll/1709189117

- Koh Samui's THB30.3 Billion Property Market Shifts Gear with Surge in Condos and Villa Rentals - Hospitality Net https://www.hospitalitynet.org/news/4128409.html